Analytics and Insights Solutions

Make more informed business decisions and manage your bottom-line.

Our data solutions help you harness all your data into actionable insights while helping you navigate rapidly-changing economic environments with confidence.

Customer Insights helped us validate the MOSCOT customer persona. It also shed light on client demographic and purchasing characteristics of customers in the eyewear industry. All of this insightful data was useful in regards to our digital strategy and marketing messaging with the acquisition of new customers.

Zachary Moscot

Chief Design Officer, MOSCOT

Make the most of your data with our Analytics and Insights Solutions

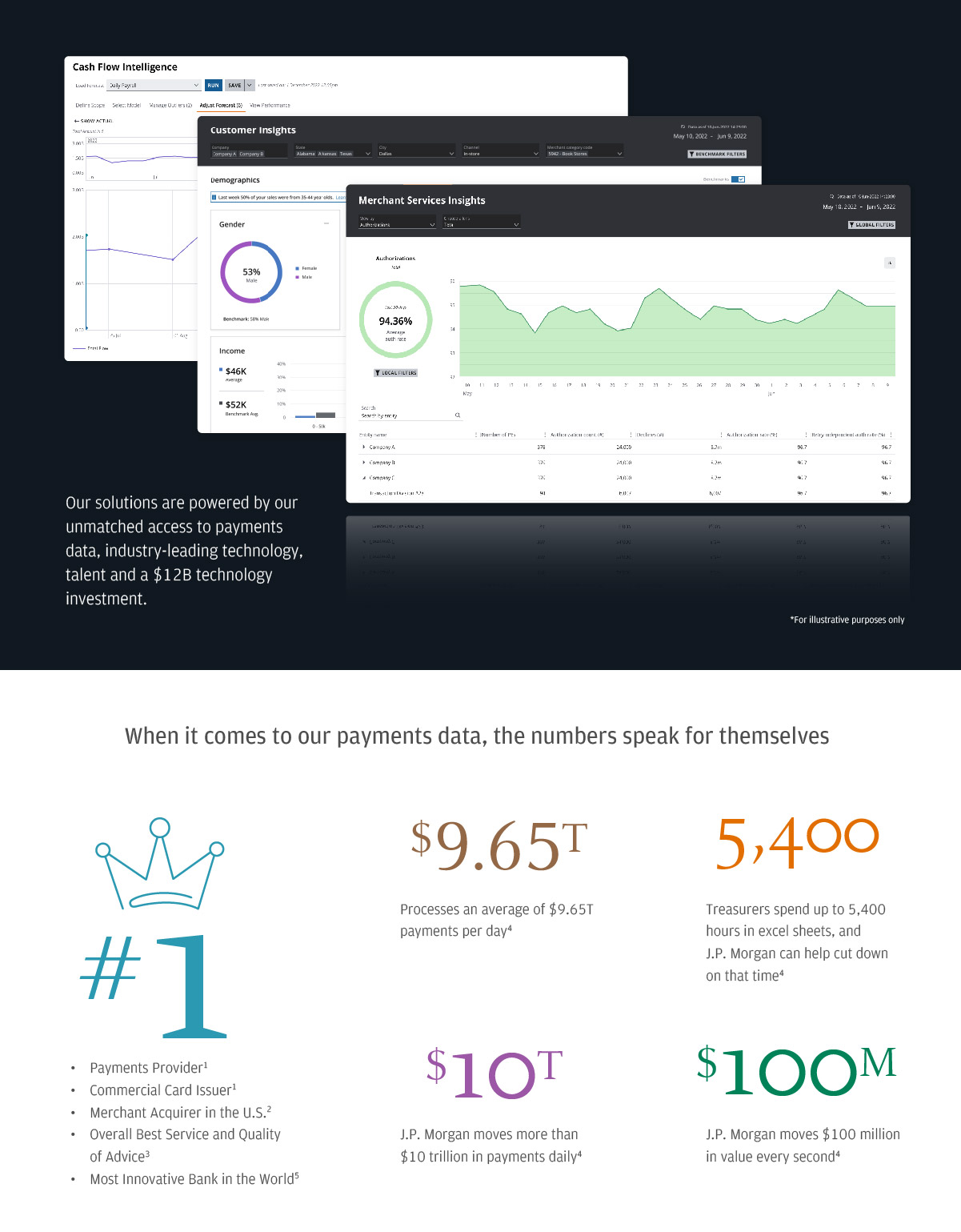

Harnessing payments data for your business is difficult. You need a partner with the global scale of a world-class bank and the innovation muscle of a tech company. That’s where we come in. Our unmatched access to payments data and industry-leading technology talent fuel our best-in-class products.

Our solutions include: Merchant Insights, Customer Insights, Forecasting through Treasurer Insights.

-

Merchant Insights

Enhance authorization rates, increase dispute win rates, mitigate care-testing attacks and more.

-

Customer Insights

Custom peer benchmarking and demographic insights are the beginning of how we can analyze your data.

-

Forecasting through Treasurer Insights

Strengthen cashflow accuracy, increase cash availability return, and find previously-invisible patterns via cutting-edge technology including AI and machine learning.

Why we offer unmatched payments data through our service, advice, and innovation:

Best-in-class:We process an average of $9.65 trillion in payments daily, so we know how to analyze and customize your data well.4

One network:

Manage and optimize payment flow with one account and a simple digital banking integration.

Support:

We support companies of any size, and our expertise allows us to provide you information before you ask the questions.

Efficiency:

A intuitive AI interface that analyses your cash flows, helps you sort, categorize and creates and forecast in seconds.

Real-time:

Access real-time visibility and customization of your data with processing speed of up to 5,400 payments in one second.3

Seamless Integration:

Reliable and accurate out-of-the-box integration and set-up via an online platform or a direct connection.

Related Insights

23:43 - Treasury

How corporate treasurers can embrace the ‘Digitization Journey’

J.P. Morgan’s Sairam Rangachari and Karen Webster, CEO of PYMNTS.com, discuss the corporate treasurer’s roadmap to digitization and the role of APIs. This is the third in a podcast series on the “Digital Transformation of Treasury.” This podcast was originally published on PYMNTS.com.

Listen now

Treasury

How corporate treasurers can integrate APIs

Oct 07, 2020

Treasurers are using APIs to move from traditional manual processes to the treasury of tomorrow. Here we explore some of the pillars behind this digital transformation strategy: automated treasury operations, real-time visibility, real-time payments and multi-bank data.

Read more

Treasury

Autoneum leverages APIs to help build a real-time treasury system for its global operations

Dec 01, 2020

Based in Switzerland, Autoneum is a tier one supplier of thermal and acoustic insulation for the automotive industry. Its innovative product range helps to make vehicles quieter, lighter and more economical.

Read moreJ.P. Morgan, JPMorgan, JPMorgan Chase, Chase, Chase Merchant Services, and Chase Payment Solutions are marketing names for certain businesses of JPMorgan Chase & Co. and its subsidiaries worldwide (collectively, “JPMC”). Nothing in this material is a solicitation by JPMC of any product or service which would be unlawful under applicable laws or regulations.

Investments or strategies discussed herein may not be suitable for all investors. This material is not intended to provide, and should not be relied on for, accounting, legal or tax advice or investment recommendations. Please consult your own tax, legal, accounting or investment advisor concerning such matters.

Not all products and services are available in all geographic areas. Eligibility for particular products and services is subject to final determination by JPMC and or its affiliates/ subsidiaries. This material does not constitute a commitment by any JPMC entity to extend or arrange credit or to provide any other products or services and JPMorgan reserves the right to withdraw at any time. All services are subject to applicable laws, regulations, and applicable approvals and notifications.

Notwithstanding anything to the contrary, the statements in this material are not intended to be legally binding. Any products, services, terms or other matters described herein (other than in respect of confidentiality) are subject to the terms of separate legally binding documentation and/or are subject to change without notice.

Any mentions of third-party trademarks, brand names, products and services are for referential purposes only and any mention thereof is not meant to imply any sponsorship, endorsement, or affiliation.

JPMorgan Chase Bank, N.A. Member FDIC. Deposits held in non-U.S. branches are not FDIC insured.

JPMorgan Chase Bank, N.A., organized under the laws of U.S.A. with limited liability.

Visit jpmorgan.com/disclosures/payments for further disclosures and disclaimers related to this content.