7 min read

Key takeaways

- To support continued growth in China, Starbucks desired a more efficient and digitized solution to manage its cross-border payables and receivables process, as well as improve liquidity management.

- Implementing a first-to-market, proprietary model that leverages big data technology and artificial intelligence (AI) helped to further enhance Starbucks’ treasury efficiencies.

- As a result, Starbucks significantly reduced workload and cross-border payments processing time, improved cash forecasting and enhanced partner relationships.

About

Headquartered in Seattle, Starbucks Corporation is the world's largest operator of coffeehouse chains, running 32,660 stores across 83 markets globally. Founded in 1971, Starbucks is regarded as a pioneer in coffee culture that has become a global phenomenon. Its 100 percent-owned China unit is currently the company’s fastest-growing market and its second largest in terms of revenue contributions. Starbucks operates more than 5,000 coffee outlets in the country that accounts for 10 percent of its global revenue1.

The challenge

Starbucks operates 17 regional centers across 200 cities in China. Shanghai is its local headquarters and serves as the treasury center responsible for processing all payments and collections for its domestic entities, including US dollar cross-border payment flows2.

As Starbucks continued its rapid expansion in China, it faced increasing workload around its treasury processes. This includes preparing and delivering large volumes of documents to its banks to support the payments, long hours dealing with back-and-forth queries regarding the documents, delays in the processing of transactions due to information discrepancies, and inefficient reconciliation. The paper-intensive and manual processes can take up to 20 days before payment reconciliation, incur FX exposure risk, and impact the company’s ability to optimize liquidity.

Starbucks desired a more efficient and digitized solution to manage its cross-border payables and receivables process, as well as improve liquidity management, to support its growth in China.

The solution

Starbucks turned to J.P. Morgan for a solution to enhance the process of executing its cross-border payment flows, and in particular, to address the pain point of having to provide countless supporting documents for such transactions that took up to 1,100 work hours a year.

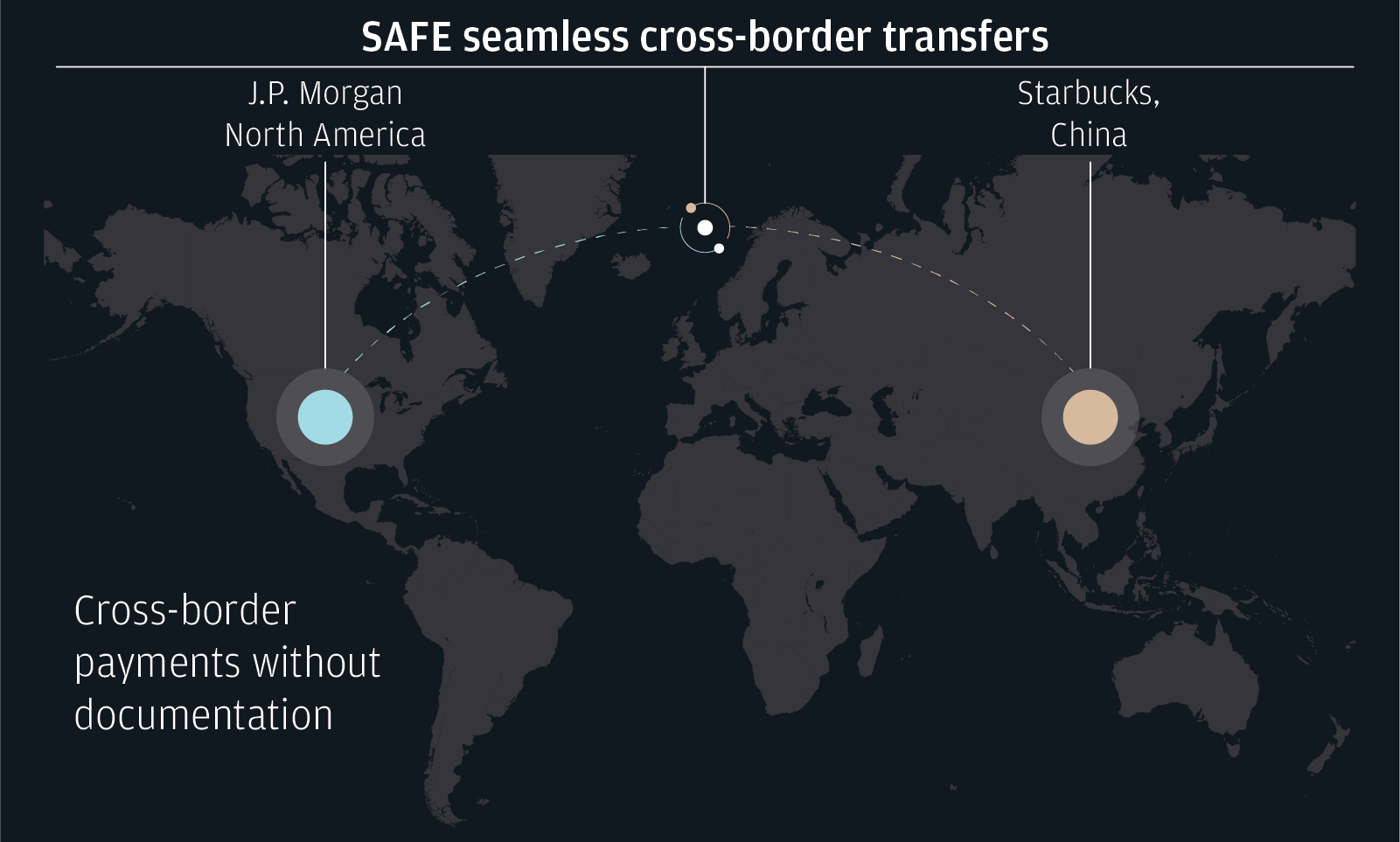

In September 2020, J.P. Morgan was appointed China’s first pilot bank for the Cross-border Simplification Program covering both good trade and service trade, an initiative by the Chinese regulator State Administration of Foreign Exchange (SAFE) that would allow select corporates to make cross-border payments without providing any supporting documents. This is a milestone program by the government to simplify cross-border flow processing. For corporates to be eligible, they would need to work closely with their financial institutions to demonstrate they have sufficient internal controls and governance around their cross-border payments and collections processes to justify not needing to produce supporting documents.

J.P. Morgan in close consultation with the coffeehouse giant, developed a first-to-market, proprietary model that leverages big data technology and artificial intelligence (AI) to monitor past cross-border payment patterns and flag anomalies that would then be raised for review by the banks.

With this solution, Starbucks only needs to provide a simple digital payment instruction to J.P. Morgan for any cross-border payment.

325

document-free cross-border transactions processed

$70M

total value of transactions processed

In addition, Starbucks also adopted leading-edge technologies like optical character recognition (OCR) and robotics process automation (RPA) to further enhance its treasury efficiencies. OCR is an AI technology capable of extracting data and text from images, scanned documents or photos, and Starbucks has automatically captured information from printed bank statements to achieve automatic reconciliation, which has saved an additional 10 work hours a month. RPA has also helped digitize Starbucks’ entire end-to-end reconciliation process for payment, collections and returned payments.

“The greatest benefit of the solution from J.P. Morgan has been to reduce the tremendous workload and processing time for cross-border settlements. The combination of the Cross-border Simplification Program and innovations like OCR and RPA has also led us to full digitization.”

Teresa Liu

Treasury Director, Starbucks China

The results

Starbucks achieved the following benefits from implementing these cross-border solutions.

-

Reduced average turnaround time of a cross-border payables management process from 20 days to three days.

-

Enhanced relationship with partners on the supply chain due to quicker and timely payments.

-

Reduced manual processes, unlocked hours of time for employees and lowered associated costs. For instance, elimination of paperwork preparation freed 50 percent of capacity for two full-time employees, and use of OCR technology saved over 10 hours a month.

-

Improved cash forecasting given certainty of payment processing. With better knowledge of payment timing, Starbucks can increase how long cash remains in yield-enhancement products, which optimizes returns.

“Adopting an entirely document-free approach to processing overseas payments represents a significant milestone for a global corporate like Starbucks and the industry as a whole.”

Brian Zhang

Head of Mnc Treasury Corporate Sales

To learn more about how we can support your business, please contact your J.P. Morgan representative.